10 September 2025

Reading time [minutes]: 22

Market and Sector Trends

Market scenarios for distributed molecular testing

The molecular diagnostics market is shifting from large laboratories to distributed and point-of-care solutions. Significant growth is expected between 2024 and 2030, driven by portable PCR, multiplex testing and cloud/AI integration. Ulisse Biomed, with its Hyris System™ platform (bCUBE™, bAPP™, ambient-stable reagents), is positioning itself as an end-to-end player capable of scaling this revolution.

Abstract

2024–2030 Overview: Global molecular diagnostics (approximately £20.7 billion in 2024) is evolving towards decentralised models, with point-of-care molecular testing expanding rapidly. Key segments such as portable PCR (68% of today's molecular market) and multiplex panels are driving innovation, while integrated AI is opening up new scenarios for predictive diagnostics.

Emerging geographies: Asia-Pacific and Latin America are seeing the highest adoption rates, driven by public investment and the need to bridge diagnostic gaps. China, for example, is seeing a CAGR of ~13.8% in molecular POC testing.

Technological drivers: Cloud solutions and AI algorithms enhance real-time data analysis, improving accuracy and reducing response times. Ambient-stable reagents eliminate the cold chain, simplifying logistics even in remote settings. Interoperability between devices and healthcare IT systems enables data-driven workflows and “Diagnostics-as-a-Service” (DaaS) models. (DaaS) models.

Regulatory and economic levers: The new European IVDR regulation raises quality and validation standards for in vitro testing, while in the US, the FDA is introducing simplified pathways (510(k) exemptions for low-risk devices and CLIA waiver certifications) to encourage decentralised testing. Healthcare systems are pushing towards value-based reimbursements, rewarding diagnostic solutions that demonstrate clinical impact and cost savings.

Decentralisation and sustainability: Bringing testing “from the lab to the patient” increases supply chain resilience (less dependence on single centres), reduces TAT (turnaround time) from days to minutes, and generates ROI through early diagnosis that reduces treatment costs. In the coming years, distributed molecular diagnostics will extend to high-margin segments – from nutraceutical quality control to customised OEM services – enabling new recurring revenue streams (devices + consumables + software).

Ulisse Biomed: In this context, Ulisse Biomed emerges as an integrated provider with Hyris System™: portable PCR devices, cloud analytics (bAPP) and proprietary reagents stable at room temperature. This modular platform supports clinicians, OEM partners and nutraceutical projects in performing advanced tests anywhere with laboratory-grade accuracy. The article examines market trends, case studies and future scenarios, outlining how end-to-end solutions such as Hyris System™ can scale in the new era of distributed diagnostics.

Snapshot

-

Distributed molecular diagnostics

Delivery of molecular tests outside centralised laboratories, e.g. in peripheral clinics, small laboratories or on the ground. It aims to bring the analysis close to the patient, reducing response times and the need for sample transport. It stands for decentralised diagnostics applied to molecular technologies (e.g. PCR).

-

Point-of-Care (POC)

Testing mode performed directly at the point of care or close to the patient. It includes rapid devices that can be used in the outpatient clinic, emergency room or in the field, providing immediate and reliable results without resorting to the hospital laboratory. It is at the heart of distributed diagnostics in the clinical setting.

-

PCR (Polymerase Chain Reaction)

Molecular technique to amplify DNA/RNA, considered the gold standard for many diagnoses (e.g. infections). The portable evolution of PCR allows advanced on-site genetic testing with high sensitivity, enabling molecular POC.

-

Multiplex Test

Analyses that simultaneously detect several targets (pathogens, genes) in a single test. For example, syndromic panels that provide a complete diagnostic picture with a single sample. They increase the efficiency and information value of each test.

-

Ambient-stable reagents

Kits and reagents formulated to remain stable at room temperature (20-30 °C) without refrigeration. They facilitate distribution in hot countries or remote areas, reducing costs and complexity of the cold chain.

-

IVDR

In Vitro Diagnostic Regulation, EU Regulation 2017/746 replacing the IVDD. It imposes stricter requirements on certification, clinical evidence, traceability and post-market surveillance for diagnostic devices, impacting both manufacturers and laboratories.

-

FDA 510(k) exempt

In the US, exemption from the 510(k) pre-market notification procedure for low-risk class I (and some class II) diagnostic devices. In practice, it allows marketing without submission of comparative data, streamlining the regulatory process. Often associated with simple or already well-established tests.

-

CLIA Waiver

US certification (Clinical Laboratory Improvement Amendments) that classifies a diagnostic test as 'low complexity', allowing it to be performed outside certified laboratories, e.g. in a pharmacy or doctor's office. Crucially, POC tests are also available in non-specialist settings.

-

Diagnostics-as-a-Service (DaaS)

Business model in which diagnostics is offered as an integrated service rather than through the sale of equipment. Typically combines loaner devices, dedicated reagents, cloud platforms and analytical support, with billing via subscriptions or pay-per-test (on the SaaS model).

- Introduction

- 1. Global market and dominant segments (2024-2030)

- 2. Adoption in emerging geographies

- 3. Technology drivers: cloud, innovative reagents, interoperability, AI

- 4. Regulatory levers and reimbursement: obstacles or accelerators?

- 5. Decentralisation as a lever of sustainability and scalability

- 6. Expansion into high-margin segments: nutraceuticals, OEMs, new use-cases

- 7. Future scenarios: competitive consolidation, M&A and integrated platforms

- 8. Ulisse Biomed positioning: the end-to-end vision

- Conclusions

Introduction

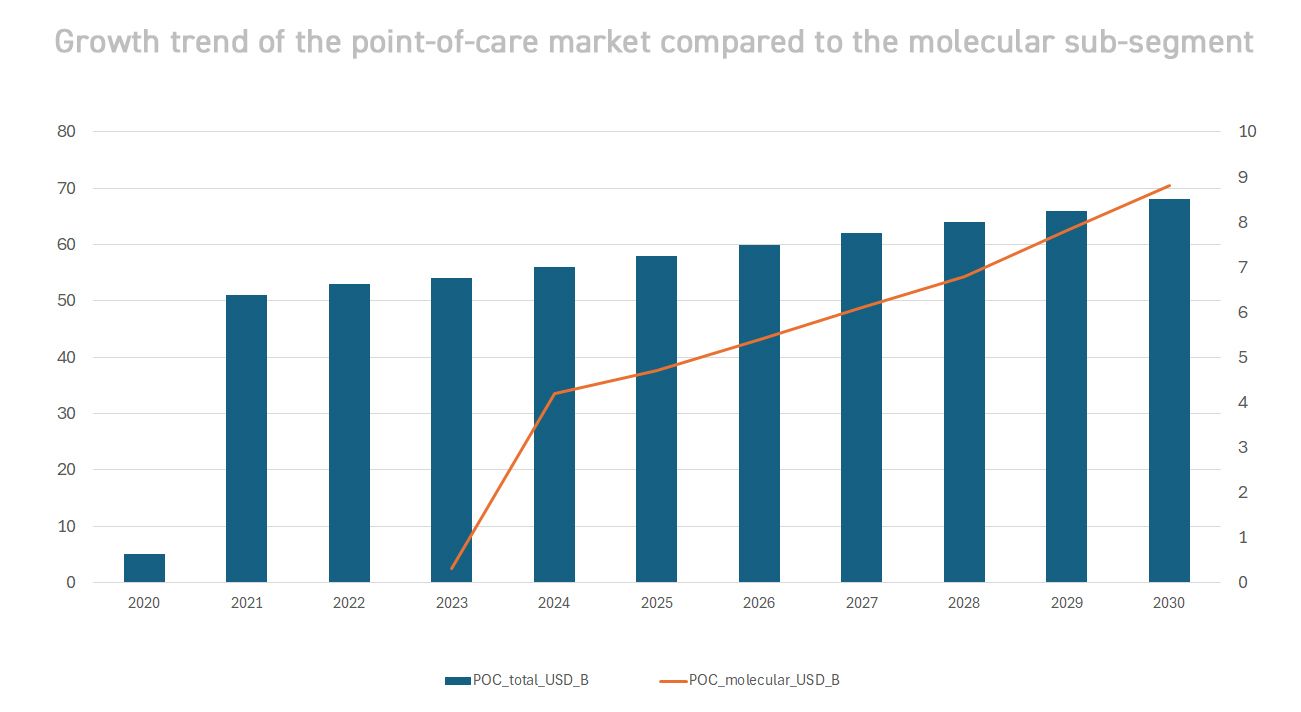

Medical diagnostics is undergoing a radical transformation, shifting from a model centred on large hospital laboratories to a paradigm distributed across the territory. Thanks to technological advances (miniaturised instrumentation, advanced optical sensors, cloud connectivity) and the lessons learned from the COVID-19 pandemic, advanced molecular tests now reach patients wherever they are. The goal is twofold: to speed up clinical response times and to expand access to diagnosis in previously excluded contexts (rural areas, emerging countries, non-hospital settings). The result is a rapidly evolving sector, with double-digit growth rates and new operating models. According to estimates, the global decentralised diagnostics market (including all point-of-care) is already worth tens of billions of dollars and continues to expand. In particular, POC molecular diagnostics – rapid genetic tests performed directly at the point of care – is the most dynamic frontier. Although it still represents a minority share of the total diagnostics market, it is growing much faster: the global value of POC molecular testing is expected to grow from ~$3.7 billion in 2023 to ~$8.8 billion in 2030, with a CAGR of ~11-12%. This growth significantly exceeds the average for the overall POC market (~5-6% per annum[2]), a sign that advanced technologies such as portable PCR are driving expansion. The trend reflects a change in approach: more and more diagnoses are being made close to the patient, reducing waiting times and improving clinical outcomes – a need that became apparent during the pandemic, when rapid field testing became an essential public health tool.

“The growth trend in decentralised diagnostics is not only quantitative but also qualitative. The way we generate value is changing: no longer just devices, but integrated platforms, data and continuous service.”

- Nicola Basile, CEO of Ulisse Biomed

1. Global market and dominant segments (2024-2030)

The global molecular diagnostics market will reach approximately USD 33 billion in 2030. Within this, the share performed in centralised laboratories remains prevalent (≈79% in 2024), but the decentralised portion gains ground year after year. The dominant segments characterising this development include:

- PCR and PCR-inspired tests: Traditional and real-time PCR remains the gold standard technology, accounting for ~68% of molecular revenue in 2024. Its reliability and sensitivity make it the gold standard. In recent years, portable and rapid variants have emerged: mini-PCR for field use, microfluidic systems and isothermal technologies (LAMP, CRISPR-based) that extend the use of molecular biology outside the laboratory.

- Point-of-Care Testing (POCT): Rapid field testing, including both molecular and immunological methods, is reshaping the industry. The global POC market (all technologies) is expected to grow from $47.8 billion (2024) to ~$68.5 billion in 2030[2]. Within this market, as we have seen, the molecular POC sub-segment is growing faster than any other. The drivers of this expansion are the ageing global population (which increases diagnostic demand), the spread of emerging infectious diseases and the push towards localised care. In many countries, performing complex tests on site has improved clinical appropriateness (earlier diagnosis, timely treatment) and the efficiency of the healthcare system. For example, the introduction of molecular POC testing for HIV and tuberculosis in rural settings has led to significant savings in treatment costs and increased adherence to treatment.

- Multiplex and syndromic tests: The ability to analyse multiple targets simultaneously with a single sample is becoming crucial, especially in infectious diseases and genetics. Multipathogen syndromic panels (e.g. respiratory panel that identifies influenza, COVID-19, RSV, etc. with a single test) enable rapid differential diagnoses and guide targeted therapeutic choices. The multiplex assay market (including both molecular and immunological multiple tests) is estimated to be growing strongly, with clear advantages over single tests in terms of efficiency and value per test. Access to multiplex POC (e.g., portable cartridges that test for dozens of pathogens) remains limited to advanced settings for now, but more affordable solutions are expected by 2030, which will broaden their use.

- AI-driven diagnostics: Artificial intelligence is emerging as a cross-cutting market segment, applied to both molecular analysis and imaging. The global market for artificial intelligence solutions for diagnostics (clinical and molecular) will grow from ~$2.6 billion in 2024 to ~$8.9 billion in 2029 (CAGR ~27.6%). In distributed molecular diagnostics, AI is integrated to automatically interpret PCR amplification curves, flag anomalies or questionable results, and optimise protocols using machine learning algorithms. For example, automatic analysis curve interpretation systems can validate a POC test in real time, reducing human error. In addition, AI allows diagnostic data to be correlated with clinical information: advanced cloud platforms can cross-reference molecular test results with medical records and vital signs, providing physicians with additional information (e.g., risk of complications, personalised treatment suggestions). Although still in their infancy, these applications outline a scenario in which each test distributed generates big data that can be exploited for population insights and predictive health models.

In summary, the market for molecular tests distributed in 2024–2030 is characterised by robust growth and functional enrichment: not only more tests and devices in circulation, but better tests (multiplex, faster, smarter) that increase their clinical impact. The portable PCR and molecular POC segments will remain the main drivers, while AI and multiplexing will act as value multipliers.

2. Adoption in emerging geographies

While North America and Western Europe currently lead the market in absolute terms (e.g., ~41% of the 2024 molecular market is in North America), emerging geographies show the highest growth potential. In Asia-Pacific and Latin America, distributed diagnostics are being embraced as a solution to expand access and address the shortage of centralised laboratories.

Asia-Pacific (APAC)

The APAC region is experiencing a real boom in POC diagnostics. China in particular, the world's second largest economy, is advancing at a CAGR of 13-14% per annum in the molecular POC segment: by 2030, the Chinese market for POC MDx testing will reach ~$1 billion. Other Asian countries are also seeing double-digit growth rates: India, Southeast Asia and South Korea are investing in portable solutions to bring advanced testing to rural communities. For example, the Indian government has launched programmes to equip peripheral health centres with portable PCR instruments for tuberculosis and COVID-19. Expanding healthcare infrastructure (new hospitals, mobile clinics) and the high prevalence of endemic infectious diseases (dengue, avian influenza, etc.) are fuelling demand for rapid diagnostics in the field. APAC is also fertile ground for public-private partnerships: local start-ups offer low-cost POC solutions, while global giants are signing agreements with Asian health ministries for large-scale supplies. As a result, Asia-Pacific is likely to be the fastest-growing region for distributed diagnostics by 2030.

Latin America (LATAM)

Latin American countries are catching up, driven by the urgency to reduce health inequalities. Many LATAM health systems are decentralising diagnostic services: for example, several federal states in Brazil have implemented networks of peripheral laboratories equipped with real-time PCR for monitoring Zika, Dengue and COVID-19. In Central America and the Caribbean, NGOs and international programmes (such as PAHO/WHO) have introduced portable devices into HIV and tuberculosis control programmes. According to one report, the molecular diagnostics market in LATAM is expected to nearly double from ~$1.1 billion in 2024 to >$2.5 billion in 2033 (CAGR ~10%). The drive comes from both public investment (e.g., the decentralisation of IVD testing in some countries has encouraged private operators to offer low-cost POC solutions[1]) and innovative private initiatives. For example, in Colombia and Mexico, some private clinics offer prevention packages that include POC molecular tests (HPV, STI) performed directly in pharmacies or at the GP's surgery, facilitating mass screening. Despite challenges such as limited budgets and sometimes inadequate infrastructure, the trajectory is clear: LATAM is embracing distributed diagnostics to expand healthcare coverage.

Africa & Middle East

In Africa, adoption is more heterogeneous but promising: countries such as Kenya, South Africa and Nigeria are investing in POC equipment thanks to global funds (e.g. PEPFAR, Global Fund)[1]. In Kenya, for example, the government has allocated $346 million to modernise peripheral facilities with new devices, involving global companies such as GE Healthcare and Philips[1]. POC diagnostics are seen as a tool for reaching remote areas and improving outcomes for diseases such as paediatric HIV (EID) and malaria. Pilot studies in Uganda and Rwanda on the use of portable PCR for tuberculosis have shown a significant increase in early diagnosis, with a reduction in community transmission. In the Middle East, Gulf countries (Emirates, Saudi Arabia) are adopting advanced POC technologies in their high-tech healthcare systems, while resource-limited regions benefit from humanitarian projects that bring rapid testing to the field (e.g., during Ebola or cholera epidemics).

Emerging markets in general provide fertile ground for distributed molecular diagnostics because they combine need (widespread infectious diseases, limited access to centralised testing) and opportunity (economic growth, investment in healthcare). However, challenges remain: in some areas, there is a lack of stable maintenance and supply chains to guarantee consumables; in addition, training programmes are needed for local operators on the use of new technologies. Despite this, analysts agree that APAC, LATAM and Africa will contribute substantially to the global growth of the POC sector over the next 5-10 years. For companies such as Ulisse Biomed, these regions represent blank spaces where early positioning can bring lasting competitive advantages.

3. Technology drivers: cloud, innovative reagents, interoperability, AI

The evolution of the distributed testing market is enabled by a convergence of technological innovations. These not only improve the performance of individual tests, but also create an ecosystem in which hardware, chemistry and software work in synergy.

Cloud connectivity and software platforms: The ability to connect POC devices to cloud applications has transformed diagnostics into a continuous stream of data. Each bCUBE™ or equivalent instrument can send results in real time to the cloud (such as Ulisse Biomed's bAPP™ platform) where they are stored, processed and made available to clinicians from anywhere. This enables centralised dashboards to monitor dozens of distributed diagnostic points (useful for clinic networks or public programmes) and allows for tele-diagnosis: remote specialists can validate a result or support therapeutic decisions. In addition, over-the-air software updates allow for continuous improvement of device performance in the field (e.g., new analysis algorithms, integration of new test panels). Cloud platforms pave the way for recurring service models: for example, subscription access to advanced analytical modules, automatic reporting for clinics, or online marketplaces for tests developed by third parties (OEMs). This “digital-first” approach creates scalable diagnostic ecosystems that can be integrated into existing healthcare information systems (EMR, LIS) via APIs, ensuring end-to-end interoperability.

Ambient-stable reagents and ready-to-use solutions: One of the often underestimated but crucial factors for the scalability of distributed testing is the robustness of reagents. Historically, many molecular tests required refrigerated or frozen reagents, hindering their use in settings without a cold chain. Today, innovative companies produce kits that are freeze-dried or formulated to be stable at room temperature for months. Ulisse Biomed itself has developed proprietary ambient-stable reagents for the Hyris system, facilitating global shipping without refrigerated logistics. These advances dramatically reduce distribution costs and times, increase the shelf life of tests (important for markets with initially low volumes), and enable on-demand use: an operator can perform a test anywhere in a few steps, as the reagents are ready to use and robust against temperature fluctuations. Consumables are also becoming more user-friendly, with single-use cartridges and simplified sample preparation systems (e.g., integrated automatic extraction), so that even non-laboratory personnel can perform complex tests with ease.

Interoperability and open standards: In an ecosystem with many new devices and platforms, interoperability is essential to avoid data silos. The adoption of standards is emerging both at the data format and communication levels (open APIs and SDKs to allow third-party developers to interface with devices). For example, the bAPP™ platform offers APIs to integrate bCUBE™ data into hospital systems or epidemiological surveillance databases. This allows the advantages of local data (immediate results where needed) to be combined with those of centralised data (aggregate analysis of big data). Interoperability also facilitates co-development models: OEM partners can create new interpretation algorithms or custom diagnostic panels in the cloud, extending the ecosystem of a platform such as Hyris System™. Looking ahead, the federation of diagnostic data from thousands of POC nodes will enable increasingly accurate AI algorithm training while keeping data localised (federated learning), and will create information bases for public health (e.g. real-time monitoring of infectious outbreaks via a distributed testing network).

Integrated Artificial Intelligence: As mentioned, AI is playing an increasingly important role. Intelligent quality control modules already exist today: software capable of automatically detecting, for example, an anomaly in the PCR amplification curve (indicating inhibition or pipetting error) and invalidating the result before it is reported, reducing false negatives/positives. Companies are developing AI assistants to guide the operator in real time (with step-by-step suggestions on the device). On the clinical front, interpretation algorithms combine multiple results: e.g., in a respiratory multiplex panel, AI can help distinguish whether multiple co-infections follow typical patterns, or signal when a certain combination of markers suggests a certain therapeutic path. Furthermore, in the field of genetic analysis, AI helps prioritise variant calling and clinical interpretation directly at the point-of-care (useful in pharmacogenomics or field oncology testing). By 2030, it is plausible that reports produced by distributed platforms will include an explainable “AI insights” section, i.e. additional information generated by AI but accompanied by understandable explanations.

Overall, these technological drivers are converging towards a new standard solution: no longer a single device or reagent, but an integrated diagnostic ecosystem. Companies such as Ulisse Biomed that have invested in an end-to-end approach (hardware + software + reagents + AI) are at an advantage, as they can control the entire user experience and optimise each component to work harmoniously. This translates into added value that is perceptible to end users (clinicians, laboratories, industrial partners): greater ease of use, reliability and the ability to evolve over time in line with technological advances.

4. Regulatory levers and reimbursement: obstacles or accelerators?

The regulatory and reimbursement policy environment plays a crucial role in the large-scale adoption of new diagnostic solutions. In the 2024-2030 period, challenges and opportunities from stricter regulations on the one hand, and incentives for change on the other, are intertwined.

- IVDR in Europe: The full implementation of the IVDR (EU Regulation 2017/746) is having a significant impact on the European diagnostics industry. Since its introduction, any new IVD test or device must meet much stricter requirements in terms of clinical evidence, quality control and post-market surveillance. In the long term, the IVDR raises the bar in terms of quality, eliminating obsolete or poorly validated products from the market and favouring companies with a solid scientific foundation. For innovative players such as Ulisse Biomed, already aligned with high standards, the IVDR can become a competitive advantage: the certification of POC platforms according to the new standards guarantees customers (hospitals, laboratories) greater confidence and reimbursement possibilities. In addition, the IVDR introduces the Companion Diagnostics (CDx) device class with a dedicated pathway, opening up opportunities for distributed molecular tests associated with specific therapies (e.g., genetic testing before administering a certain biological drug). In summary, while in the short term the IVDR is a challenge to be managed (requiring expert regulatory advice, robust clinical studies, etc.), in the medium term it will build a more solid and reliable European market, from which the best products will emerge stronger.

- FDA and regulatory simplifications: In the United States, the FDA has historically taken a strict approach to diagnostic devices, but some targeted relaxations are now in place. For example, many classes of low-risk IVD devices have been made 510(k) exempt, i.e. exempt from the standard premarket notification procedure. This typically applies to very simple tests or those equivalent to others already approved. In the field of molecular POC, the main route remains 510(k) clearance or de novo (for innovative technologies without predicate devices), but the FDA has shown flexibility in emergency contexts: during COVID-19, it granted EUA (Emergency Use Authorisation) to numerous POC tests in record time, temporarily lowering some barriers to entry. There is also discussion of a potential framework for certain low-risk decentralised tests that could fall into exempt or simplified categories. In addition, the aforementioned CLIA waiver plays a crucial practical role: obtaining a CLIA waiver for a POC device (as provided by the FDA pathways for CLIA-waived molecular tests - CLIA Waiver by Application and CLIA Categorisations [4][5]) means enabling its widespread use in thousands of clinics and pharmacies without requiring highly trained personnel. The CLIA waiver process requires demonstrating that the test is “so simple as to minimise the risk of erroneous results” – a goal that also guides the design of new POC devices (which are increasingly automated and fool-proof). In summary, regulation in the US is seeking a balance between ensuring efficacy/safety and promoting rapid innovation: 510(k) exemptions and CLIA waivers are levers that, if exploited, accelerate the arrival of distributed technologies on the market.

- Quality standards and green certifications: One final emerging factor is environmental sustainability in healthcare supplies. Some public tenders (especially in Northern Europe) are beginning to include environmental impact criteria: for example, extra points for reagents that reduce biohazard waste, or for solutions that minimise emissions (cold chain, transport). In the future, distributed diagnostic platforms could benefit from this sensitivity if they demonstrate a lower ecological footprint (e.g., thanks to room-temperature-stable reagents that eliminate tonnes of dry ice in shipments). Quality certifications such as ISO15189 for POCT performed outside the laboratory, or specific accreditation programmes for DaaS services, could also become the norm as distributed diagnostics become an integral part of the healthcare system.

Ultimately, the regulatory environment for 2024–2030 presents both barriers to overcome and levers to activate. Companies with a solid regulatory and reimbursement strategy – able to anticipate IVDR requirements, quickly obtain FDA clearances/waivers and produce outcome data – will be the ones that turn potential obstacles into competitive advantages. Ulisse Biomed, for example, has integrated regulatory compliance into the design of the Hyris System™ from the outset and is investing in clinical studies and economic dossiers to demonstrate the value of its solution in various contexts (clinical, nutraceutical, industrial), thus preparing itself to engage proactively with regulatory bodies and payors.

5. Decentralisation as a lever of sustainability and scalability

Implementing a network of distributed molecular testing is not only a technological choice, but also a system strategy that impacts the economic and organisational sustainability of healthcare. Several aspects make decentralisation a driving force for the scalability of diagnostic services:

- Return on investment (ROI) and cost savings: Distributing testing across the territory can significantly reduce downstream costs. Faster diagnoses mean timely treatment, fewer complications and therefore savings for hospitals and insurance companies. For example, every hour gained in diagnosing an acute myocardial infarction improves the outcome and reduces the number of days spent in hospital (average cost >£500 per day). A POC molecular test for cardiac markers, while costing more than a central lab test, can save thousands of pounds by avoiding delays and unnecessary intensive care. Similarly, in the case of infectious diseases such as influenza or COVID-19, knowing the result immediately with a PCR test at the chemist's can avoid unnecessary prescriptions of antibiotics or further tests, with economic and clinical benefits. Numerous health technology assessment studies have quantified these benefits: Unitaid, for example, has estimated millions of dollars in HIV treatment costs saved in programmes that have introduced POC EID (Early Infant Diagnosis) in Africa. From a laboratory perspective, decentralised testing reduces the workload on reference centres, allowing laboratory resources to be allocated to more complex cases and improving overall operational efficiency. Finally, DaaS models shift spending from capex (instrument purchase) to opex (testing costs), synchronising costs with actual usage and facilitating financial sustainability over time.

- Supply chain resilience: The pandemic has taught us the importance of having flexible and robust supply chains. A centralised model tends to be fragile: if the hub laboratory experiences an overload or a shortage of reagents, the entire system is affected. In contrast, a widespread network of POC devices with stable and diversified reagents is inherently more resistant to shocks. For example, during COVID-19, many countries integrated small, decentralised PCR instruments for rapid testing: in the event of delays in supplies to the central laboratory, at least essential testing could continue locally. Decentralisation also reduces the need for sample transport (which was a bottleneck during lockdowns and restrictions). Less transport and handling means fewer points of possible disruption. Furthermore, the distributed model pushes towards standardisation and simplification: if you have 100 mini-labs across the territory instead of 1 mega-lab, there will be a tendency to create kits that are easier to distribute and procedures that are more streamlined and interoperable. All of this increases the system's ability to adapt quickly in the event of new health emergencies or sudden changes in demand (scalable flexibility). A concrete example: local production of reagents. Some POC platforms allow local partners (e.g., a company in LATAM) to produce reagent kits under licence, reducing dependence on imports. This not only speeds up delivery times but also creates self-sufficient regional ecosystems, improving health sovereignty.

- Accessibility and equity: From a macro perspective, more widespread diagnostics means greater equity in access to care. This also has positive repercussions on social sustainability. Reaching patients who were previously excluded (due to geographical distance, travel costs, lack of local specialists) means identifying diseases earlier and treating them sooner, reducing the economic burden of advanced diseases on society. Consider neonatal screening or cervical screening programmes: bringing HPV DNA testing directly to peripheral health districts increases women's adherence to screening and allows precancerous lesions to be treated before they develop into invasive cancer – saving countless lives and future costs. Similarly, in rural settings, the availability of rapid molecular tests for TB or malaria in local clinics avoids costly hospital transfers and epidemic outbreaks. These benefits, which are difficult to monetise in the short term, translate into long-term sustainability for healthcare systems.

- Modular scalability: Another advantage of decentralisation is progressive scalability. Instead of making a massive investment in a single centralised laboratory (which may then remain underutilised if demand is lower than expected), healthcare systems can invest gradually: for example, by activating POC devices in a few pilot areas, then expanding the network as it proves effective. Each additional device increases total diagnostic capacity in an almost linear fashion. This modular approach is highly valued by international funds and investors in global healthcare because it allows the impact to be measured step by step and reduces the risk of wasted resources. On the industrial side, suppliers usually favour this modular scalability by offering easily replicable turnkey solutions (the famous diagnostic plug-and-play). Additional software modules (e.g. new test panels) can be distributed via the cloud without having to replace the hardware, increasing both functional and quantitative scalability.

In summary, decentralisation brings about a paradigm shift: diagnostics is no longer seen as a fixed cost centre, but as a widespread infrastructure that grows with demand and generates value in terms of resilience and outcomes. Of course, governance is needed to coordinate the network (e.g., defining which tests to perform at the point of care and which to centralise, ensuring consistent quality, collecting data in an integrated manner), but experience in recent years clearly indicates that community-based healthcare systems are more effective and sustainable. Distributed molecular diagnostics is therefore a strategic pillar for the healthcare of the future, alongside telemedicine and digital health, in a model where prevention, diagnosis and monitoring take place anywhere, anytime.

6. Expansion into high-margin segments: nutraceuticals, OEMs, new use cases

In addition to its core business of clinical diagnostics, the period 2024–2030 will see molecular diagnostics spreading into adjacent sectors, which are often characterised by attractive margins and innovative business models.

Nutraceuticals and wellbeing

The dietary supplement and nutraceutical industry is growing rapidly, and with it, the demand for quality testing throughout the supply chain. There is a “hidden market” for molecular testing to verify the authenticity and purity of natural ingredients (botanicals, plant extracts, probiotics) used in supplements. For example, DNA barcoding or PCR techniques can confirm that an herbal extract truly contains the declared species and is not adulterated with less expensive substances. In addition, on the consumer front, wellness-related omics tests are becoming more widespread: gut microbiota tests, nutritional genetic tests for personalised diets, etc. These tests, which are not strictly diagnostic in the clinical sense, constitute a premium segment aimed at the paying end consumer (B2C) or integrative medicine clinics. Ulisse Biomed, for example, with its portable platform, can serve contract laboratories that offer microbiota panels directly to nutritionists. Margins and pricing in this area tend to be high, given consumers' willingness to pay for personalised insights into their health. Being present in the nutraceutical sector allows for business diversification and scaling of test volumes even outside the rigid framework of public health reimbursements.

Integrated OEM and co-developments

Many large players (pharmaceutical, biotech, veterinary, agri-food companies) need customised diagnostic solutions to integrate into their products or services. Examples: a pharmaceutical company developing a new cancer drug may also want to offer a companion test to select patients (classic pharma + diagnostics model); a veterinary equipment manufacturer may want a custom version of a portable PCR test for veterinary clinics; or agri-food companies may want to integrate a molecular device to monitor pathogens in livestock farms or food production. All these cases fall under the OEM (Original Equipment Manufacturer) model or B2B partnerships. For a company like Ulisse Biomed, providing white-label platforms or co-developing specific panels at the request of partners is strategic: it allows it to sell high volumes of dedicated consumables and perhaps software licences, without the costs of end-user marketing. Small biotech companies with innovative technologies may prefer to rely on an existing ecosystem such as Hyris System™ rather than building hardware and cloud from scratch, licensing their diagnostic assays to run on the bCUBE™. These OEM partnerships generate recurring revenues and create solid barriers to exit (once a test is integrated into a partner's industrial or clinical workflow, it is unlikely to be removed in the short term). The OEM diagnostics segment is expected to grow, fuelled in part by the trend towards companion diagnostics and the need for rapid testing in various industrial sectors (environmental, food safety, etc.).

Point-of-Care in new clinical contexts

The early years of molecular POC diagnostics focused on infectious diseases (respiratory, HIV, etc.) and emergency contexts. However, the future will see an expansion into high value-added clinical segments: oncology (portable liquid biopsies for key mutations, for example in peripheral cancer centres), women's health (molecular tests in gynaecology: HPV, vaginal infections), chronic diseases (monitoring panels for diabetic or nephropathic patients to detect complications early). Another area of opportunity is occupational and sports medicine: imagine rapid genetic tests to assess predispositions or athletic recovery, performed on-site in sports centres or companies (a potential corporate market). These uses go beyond the traditional “laboratory test” and become part of integrated services (prevention plans, corporate wellness programmes, etc.). As they are often not covered by standard reimbursements, they are offered privately at a premium price. For example, some private clinics offer advanced check-up packages that also include rapid molecular tests (from sexually transmitted infections to genetic metabolic predispositions): the patient pays for the convenience of having immediate answers and a complete picture within the day.

In all these ‘non-traditional’ segments, decentralisation and speed are strong added values, and POC technology manufacturers can adapt their offerings to penetrate them. A careful positioning strategy will be needed for each vertical (e.g., in nutraceuticals, focus on supply chain quality certification; in oncology, focus on complementing laboratory tests; in OEM, ensure flexibility and development support). Ulisse Biomed's ability to act as an ‘enabling platform’ – with modular hardware and software on which to build specific applications – will be an important asset in seizing these high-margin opportunities.

7. Future scenarios: competitive consolidation, M&A and integrated platforms

By 2030, we expect the molecular diagnostics landscape to be quite different from today's, as a result of consolidation and maturation of the sector. Some key trends on the horizon:

- M&A and consolidation: In recent years, we have already seen major strategic acquisitions led by industry giants. This means that we could see a reduction in the number of small independent players as they are absorbed by larger ones. For biotech investors, this scenario is interesting from an exit perspective: start-ups with innovative technologies but limited commercial networks could become acquisition targets, achieving significant multiples. At the same time, we may see mergers between specialised players (e.g., a company strong in reagents with one strong in portable devices) to combine complementary skills. One risk of consolidation is the possible decline in competition and innovation if too many players are absorbed, but it is also true that the entry of the big players brings capital and production capacity to scale POC technologies to global levels.

- Strategic partnerships and ecosystems: Not all collaborations will take the form of M&As. There will be room for joint ventures and non-equity partnerships: for example, co-marketing agreements between POC device manufacturers and cloud/AI platform providers to offer integrated solutions; or agreements between diagnostic companies and big tech (to integrate diagnostics into wearables or the digital health ecosystems of Apple, Google, Amazon, etc.). Already today, companies such as Microsoft and Amazon Web Services offer cloud platforms specific to the healthcare sector that could interoperate with POC devices (providing, for example, scalable on-demand AI services).

- SaaS + cloud platforms (diagnostic cloud ecosystems): A very likely scenario is that diagnostic solutions will increasingly become digital platforms, where hardware is only one component. Business models will tend towards SaaS: imagine a laboratory or hospital subscribing to have X devices installed, connected to cloud software that provides analysis, updates and support, perhaps paying on a monthly basis for the number of tests performed (pay-per-use). This “diagnostics-as-a-service” model is emerging and will be a paradigm shift for an industry historically based on the sale of instruments and reagents. From a business perspective, this generates more predictable recurring revenue and an ongoing relationship with the customer. From the customer's perspective, it shifts the burden of maintenance and updating to the supplier, ensuring that they always have state-of-the-art technology without having to reinvest capital. Additional SaaS elements will include diagnostic app stores: platforms such as bAPP™ could evolve to host third-party developed tests that can be downloaded/activated on-demand (similar to how one downloads an app on a smartphone today). In short, hardware will become like a diagnostic smartphone, and the cloud will be its ecosystem of services.

- Regional white spots and new markets to penetrate: Despite globalisation, there will still be underserved markets in 2030. Consider, for example, regions of sub-Saharan Africa or Central Asia where healthcare is only now investing in infrastructure. These will be the markets of the future for distributed diagnostics – regions where there is not yet a dominant player and where the first to arrive can build lasting relationships with local governments and partners. Some countries with huge populations (Nigeria, Pakistan, Bangladesh) represent immense opportunities if they accompany economic growth with healthcare investments. At the same time, sectors such as veterinary medicine and food safety could be emerging markets for decentralised molecular testing: for example, farmers using portable kits to monitor infections in animals in real time, or food inspectors testing for contaminants in the field with environmental PCR. These are still largely unexplored fields but have the potential for explosive growth in terms of demand. Companies that manage to adapt or reposition their platforms for these white spots will reap the rewards.

- Performance evolution and new paradigms: Looking ahead, we could also imagine a technological breakthrough that would further change the game: for example, the advent of ultra-fast portable sequencers (pocket-sized nanopore sequencers already exist today, but in the future they could become truly mainstream, bringing metagenomics into the field), or molecular biosensors integrated into smartphones (chips that perform amplification and reading directly on the phone). If such technologies emerge, the very definition of “distributed molecular testing” will expand further to include wearable devices or networks of environmental sensors. In any case, the spirit of the scenario remains: bringing analytical power where it is needed, when it is needed.

8. Ulisse Biomed positioning: the end-to-end vision

In this landscape of innovation and change, Ulisse Biomed stands as an enabler and leader in distributed molecular diagnostics. Its Hyris System™ platform embodies the key principles discussed so far:

- End-to-end integration: Unlike fragmented approaches, Ulisse Biomed controls and integrates all components: hardware (bCUBE™ – miniaturised portable PCR device), software (bAPP™ – cloud and AI application for data management and analysis), chemistry (proprietary stable and validated kits) and services (technical support, OEM customisation). This unified ecosystem ensures that each component is optimised to work with the others, offering end users a seamless experience. In practice, this means laboratory accuracy anywhere, in line with the company's mission.

- Scalability and flexibility: Hyris System™ is designed to be scaled both vertically and horizontally. You can start with a single bCUBE in a remote laboratory and end up managing a fleet of hundreds of devices in the cloud. The platform supports the development of new tests (customised panels for OEM partners, new sectors such as microbiota, veterinary medicine, agrifood) with rapid development times thanks to a flexible framework. This means that Ulisse Biomed can respond quickly to new market demands (e.g. sudden need for a test for a new pathogen) by distributing a software update and reagent kits in a matter of weeks.

- Focus on the user and ROI: With clinicians and end users in mind, the company has focused on extreme usability (the bCUBE is designed to be used even by non-specialised personnel, following a few intuitive steps) and on performance metrics that matter to customers: speed (results in 90 minutes or less), portability (lightweight and robust device, transportable in a carrying case), low operating costs (thanks to stable reagents that reduce waste and transport costs).

- Strategic vision and partnerships: Ulisse Biomed does not see its role as limited to “selling equipment”, but rather as a strategic partner for those who want to innovate in diagnostics. It has already established collaborations with private laboratories to offer nutrigenetic tests on the Hyris platform, and is open to projects with pharmaceutical companies to jointly develop companion diagnostic solutions. In addition, the company is in dialogue with academic institutions to validate new panels (HPV, sepsis, rare diseases) and with public bodies for pilot projects in territorial epidemiological surveillance based on bCUBE networks (a concept of distributed surveillance where each machine in the field becomes a sentinel node, contributing real-time data to a central observatory). This ability to weave a network around its technology is essential to remain at the forefront and expand its impact.

- Continuous innovation: Consistent with the trends discussed, Ulisse Biomed is integrating AI and cloud analytics into its bAPP. For example, it uses proprietary algorithms to check the quality and validity of each PCR run, and its roadmap includes prediction functions (e.g., correlating viral loads with outcome probabilities) and federated machine learning to continuously improve test accuracy with data collected in the field. The company also closely monitors hardware developments: for example, an automated tool for sample preparation for the analytical phase is currently under development. This open innovation mindset ensures that Hyris System™ remains not a static product, but an evolving platform in line with the state of the art and emerging customer needs.

In conclusion, Ulisse Biomed presents itself as a virtuous case study of how a company can position itself in the 2024–2030 market: solid strategic vision (decentralisation as the key to sustainability), technical mastery (integrated modular ecosystem) and customer focus (solutions tailored to the needs of clinicians, partners and investors). This combination enables it to successfully scale up in distributed markets and emerging segments. As the sector moves towards consolidation and SaaS models, Ulisse Biomed – with its strong identity as an end-to-end provider – has the tools to not only adapt to change, but to drive change towards diagnostics that are closer to the patient, smarter and more sustainable.

Conclusions

The decade from 2024 to 2030 promises to be a period of accelerated evolution for distributed molecular diagnostics. From robust global market growth to expansion into new geographies and sectors, to convergence with digital and AI, we have outlined scenarios rich in opportunity. For biotech investors, laboratory managers, OEM partners, and healthcare decision-makers, the message is clear: decentralised testing is no longer an experimental niche, but a central phenomenon set to redefine care paradigms and business models. In this context of transformation, Ulisse Biomed presents itself not only as a technology provider, but as a strategic partner capable of accompanying healthcare organisations and systems towards the future of diagnostics. The journey towards more widespread, resilient and intelligent molecular diagnostics has begun. The coming years will see the fruits of today's investments consolidate and the emergence of businesses and models that are unthinkable today. Those who can anticipate trends – focusing on innovation, interoperability, quality and value – will lead the new era. Ulisse Biomed, with its Hyris System™ ecosystem, aims to be one of these pioneering leaders, bringing diagnostic excellence wherever it is needed and generating tangible value for patients, operators and financial stakeholders. The laboratory of the future is widespread, connected and data-driven: the foundations have been laid, and the market is ready to grow.

Sources and Bibliography

Sources and Bibliography

- [1] [2] [3] Point of Care Diagnostics Market Size, Share & Trends Analysis Report by Product (Infectious Diseases, Glucose Testing, Cardiac Markers), End Use (Clinics, Home, Hospitals), Region, with Growth Forecasts, 2025–2030

- [4] FDA — CLIA Waiver by Application

- [5] FDA — CLIA Categorizations

- [6] Ulisse Biomed — Decentralised Diagnostics: Growth and Future of the Market